| |

CORPORATE AND GROUP

HIGHLIGHTS

· Record results for Net Profit After Tax of $1.007 billion, and Earnings per Share of $1.37.

· Rewarded shareholders with total dividends announced for FY2005 of 62 cents per share, fully franked.

· Share buyback programs achieved 24.4 million net reduction in shares, resulting in 3% improvement in future earnings per share.

· Lost time injury frequency rate for Group was a record low 0.8 hours lost per million hours worked during year.

· $2 billion growth program underway involving over 20 major projects in eight countries. |

|

COATED AND BUILDING PRODUCTS ASIA

KEY CUSTOMERS: Building and construction industries and general manufacturers.

HIGHLIGHTS:

· 40th anniversary of operations in Asia.

· Announced $100 million investment in India to construct three new manufacturing facilities at Pune, Chennai and New Delhi.

· BlueScope Steel China team secured contract to supply steel building products for world's tallest building, under construction in Shanghai.

· Asia-wide launch of new, improved Clean COLORBOND® steel.

· Entered into alliance with Nippon Steel for marketing of corrosion-resistant SuperDyma™ steel.

· Investments in major capital projects in Thailand, Vietnam and China underway. |

|

COATED AND BUILDING PRODUCTS AUSTRALIA

KEY CUSTOMERS: Building, construction, automotive and packaging industries and general manufacturers.

HIGHLIGHTS:

· Springhill achieved annual despatch record (1.005 mt) - the third consecutive annual record and first time 1.0 mt reached.

· Four year site-based Enterprise Bargaining Agreement (EBA) at Western Port certified.

·New products launched included

W-Dek, Quikform and new improved ZINCALUME®.

· Construction of new state of the art COLORBOND® facility in western Sydney.

· BlueScope Water urban rainwater tank and drainage pipe production facilities established in Victoria, NSW and Queensland. Perth-based Pioneer Water Tanks acquired. |

|

|

|

|

| EXTERNAL DESPATCHES ('000s of tonnes) |

| Domestic |

600 |

|

| Export |

74 |

|

| REVENUE |

$1.05 |

billion |

| EBIT |

$82 |

million |

| NET OPERATING ASSETS |

| (pre-tax) |

$878 |

million |

| RETURN ON NET ASSETS |

| (pre-tax) |

11.5% |

|

|

| EXTERNAL DESPATCHES ('000s of tonnes) |

| Domestic |

1,195 |

|

| Export |

477 |

|

| REVENUE |

$3.19 |

billion |

| EBIT |

($116 |

million) |

| NET OPERATING ASSETS |

| (pre-tax) |

$1,427 |

billion |

| RETURN ON NET ASSETS |

| (pre-tax) |

8.7% |

|

|

|

|

|

|

|

|

HOT ROLLED PRODUCTS

KEY CUSTOMERS: Engineering, construction, mining and manufacturing industries and export customers who re-roll our steel.

HIGHLIGHTS:

· Port Kembla maintained near-record raw steel production (5.123 mt).

· Achieved record annual hot rolled coil production (2.522 mt).

· Record annual production (1.824 mt) and record annual despatches

(1.778 mt) at North Star BlueScope Steel.

· North Star BlueScope Steel voted number one flat rolled steel supplier in North America for third consecutive year in the Jacobson survey of steel customers. |

|

NEW ZEALAND STEEL

KEY CUSTOMERS: Building and construction industry, roll-formers and manufacturing industries.

HIGHLIGHTS:

· Record sales revenue of $756 million.

· Strong results in both domestic and export markets, with record domestic despatches of 315,000 tonnes.

· Three year Employment Contract agreed, with no lost time or industrial action.

· Improvements to management systems and replacement of ageing finance, maintenance and supply systems to support improved productivity. |

|

COATED AND BUILDING PRODUCTS NORTH AMERICA

KEY CUSTOMERS: Consumers of pre-engineered buildings (PEB) and aluminium and glass architectural products.

HIGHLIGHTS:

· Integration completed, and transformation of business underway with establishment of five regional profit centres and new management team.

· Work performance system implemented to increase production capability, reduce costs and improve inventory management.

· Robust Vistawall business continues to grow well.

· Production at high-cost Galesburg facility ceased in April. |

|

|

|

| EXTERNAL DESPATCHES ('000s of tonnes) |

| Port Kembla: |

| Domestic |

1,050 |

|

| Export |

1,377 |

|

| North Star BlueScope Steel: |

| Domestic |

883 |

|

| Export |

6 |

|

| Total: |

| Domestic |

1,933 |

|

| Export |

1,383 |

|

| REVENUE |

$3.94 |

billion* |

| EBIT |

$1,338 |

billion |

| NET OPERATING ASSETS |

| (pre-tax) |

$2.03 |

billion |

| RETURN ON NET ASSETS |

| (pre-tax) |

66.5% |

|

|

| EXTERNAL DESPATCHES ('000s of tonnes) |

| Domestic |

315 |

|

| Export |

276 |

|

| REVENUE |

$756 |

million |

| EBIT |

$183 |

million |

| NET OPERATING ASSETS |

| (pre-tax) |

$474 |

million |

| RETURN ON NET ASSETS |

| (pre-tax) |

39.3% |

|

|

| EXTERNAL DESPATCHES ('000s of tonnes) |

| Domestic |

177 |

|

| Export |

10 |

|

| REVENUE |

$1,135 |

billion |

| EBIT |

($20 |

million) |

| NET OPERATING ASSETS |

| (pre-tax) |

$234 |

million |

| RETURN ON NET ASSETS |

| (pre-tax) |

(8.4%) |

|

|

|

|

|

* excludes North Star BlueScope Steel |

|

|

|

| |

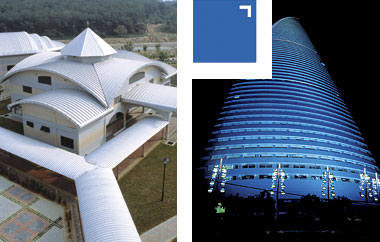

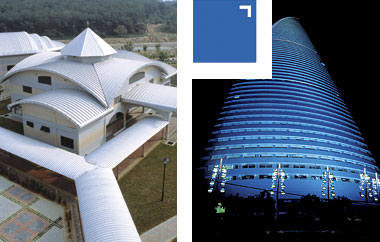

Our steel building products feature in many examples of contemporary architecture throughout the region.

ASIA COATED AND BUILDING PRODUCTS

The world's economic centre of gravity continued its shift toward Asia in 2004/05. We are extremely well positioned in this exciting region, and have continued investing in our Coated and Building Products Asia business, growing our painting, metallic coating, rollforming and pre-engineered buildings (PEB) operations across Asia.

BlueScope Steel is Asia's leading PEB manufacturer, and our rollforming, painting and metallic coating network is the region's most extensive. We are a leading Australian investor in Asia, and in 2004/05 we achieved a major milestone with 40 years experience 'on the ground' in the region. Our Asian business unit consists of metallic coating and painting operations in Thailand, Indonesia and Malaysia; BlueScope Buildings (formerly Butler and Lysaght) facilities in China; and BlueScope Lysaght operations in eight other countries in Asia.

THROUGH OUR ASIA BUSINESSES, WE ARE ALIGNING OUR GROWTH WITH SOME OF THE WORLD'S MOST VIGOROUS ECONOMIES.

In the 2004/05 financial year we continued expanding our business platform to further capitalise on Asia's economic growth. We have a number of exciting new projects in the region. These include an additional metallic coating line in Thailand, and metallic coating and painting facilities in Vietnam and China, which will double our capacity to approximately one million tonnes. We have also approved major projects in China, Thailand and India to manufacture the LYSAGHT® and BUTLER® range of building solutions. In total, BlueScope Steel has now committed over $710 million to investments in Asia in the last two years.

For Coated and Building Products Asia,

2004/05 saw a pause in the continuous profit

growth of the preceding five years. This is a

result of increased business development and pre-production costs, adverse foreign exchange

movements and profit from asset sales

impacting on the previous year's results.

EBIT for the year was $82 million, down from

$104 million in 2003/04. Higher steel purchase

prices were offset by increased selling prices.

In 2004/05, sales revenue was $1.051 billion,

up from $699 million the previous year, greatly

assisted by the full-year contribution and higher

selling prices of BUTLER® PEBs. The full year

effect of our Butler Manufacturing acquisition

was significant, with the Butler business in

China contributing EBIT of $16 million. Volumes

increased year on year predominantly due

to Butler. Growth in the coating lines was

constrained by capacity.

Our investment strategy recognises the strong

long-term growth potential of Asia's economies.

We are creating new markets across Asia for

premium steel building products such as Clean

COLORBOND® steel and ZINCALUME® steel,

and advanced solutions such as LYSAGHT®

building products and BUTLER® PEBs.

Our approach to growing local markets requires

continued investment to meet demand for steel

products. We expect to reap benefits as our

new downstream operations begin to generate

earnings from the rapidly growing Asian

construction market over the coming few years.

Our businesses in Asia delivered many highlights

in 2004/05. The BlueScope Steel China team

secured the contract to supply steel building

products for the world's tallest building. We

executed a successful Asia-wide launch of new,

improved Clean COLORBOND® steel, and we

enhanced our reputation for quality through an

alliance with Nippon Steel Corporation for the

marketing of corrosion-resistant SuperDyma™

steel. In addition, we have continued to

implement an Enterprise Resource Planning (ERP)

platform for our businesses in Asia. Malaysia

and Indonesia are operating under this system,

while ERP work continued in China and Vietnam.

CHINA

BlueScope Steel is well positioned to grow in

the expanding Chinese steel building products

and pre-engineered buildings markets. We

began in-country operations in China in 1995,

and now run six manufacturing plants across

the country, as well as one in Taiwan, with

three more facilities being developed.

In 2004/05, building construction continued on

our $280 million metallic coating and painting

facility at Suzhou, 80 km west of Shanghai.

An impressive facility is taking shape, and

commissioning is planned for the middle of 2006

calendar year. During the year, we achieved

an important step with the successful launch

of our ZINCALUME® steel brand into China.

We also merged our Butler and Lysaght

operations, with the integrated BlueScope

Buildings China business managed by one team.

Accordingly, we approved our Company's

first combined BUTLER® PEB-LYSAGHT®

facility. The plant, located in Guangzhou, will

cost $45 million. Site works are progressing,

registrations and approvals are complete,

and the project is on schedule for completion

by the middle of 2006 calendar year.

During the year, we expanded our BlueScope

Buildings Tianjin site into a full-service PEB

operation, investing in a new beam fabricating

line with a capacity of 12,000 tonnes per

annum. The $8 million Tianjin project was

completed on time and under budget. To meet

the ever-increasing demand for sophisticated

building products, we approved a $16 million

expansion of our Langfang facility to produce

architectural and sandwich panels for

premium facade applications.

In 2004/05 our China team successfully bid

for a Shanghai World Finance Center contract,

calling for supply of 220,000 square metres

of LYSAGHT 3W-DEK. The structural decking

product will form part of the flooring system

in what will become the world's tallest

building. This 101-storey Shanghai project is

yet another showcase for BlueScope Steel in

China, and enhances our reputation for steel

building products of the highest quality.

During the year, the Chinese government

tightened funding available to local companies,

and this policy altered our BlueScope Buildings

China customer base. Sales to large Chinese

companies have fallen, but we have increased

sales to foreign-owned direct investors.

Clockwise from left: We now employ over 3,000 people across Asia, including Ardhian Yoga Oetoro, BlueScope Lysaght Indonesia and sales engineer Pang Howe Koh, Singapore. A unique expression of COLORBOND® steel rollformed into tiles in Indonesia; Suzhou facility under construction in China.

INDIA

Alongside China, India is emerging as a major

economic powerhouse, with a consequent

increase in building and construction sector

demand. BlueScope Steel has been creating

markets for COLORBOND® and ZINCALUME®

steels in India since 1998, and in 2004/05 we

announced an investment of $100 million in

three new manufacturing facilities to meet

growing demand. This represents our

largest-ever initial greenfield downstream

investment in any country. These new

facilities are at New Delhi in the north,

Pune in the west, and Chennai in the south.

The Pune facility, which will manufacture

BUTLER® PEBs, and include a Design Centre,

is due for start-up in the second half of the 2006

calendar year. The New Delhi and Chennai

plants will provide Lysaght rollforming

services, and offer a full range of LYSAGHT®

products. They will commence operations in

mid-2007 calendar year. A network of 18 new

sales offices will help grow our reach in the

Indian building and construction markets.

We are also examining the feasibility of a

joint venture with India's respected Tata Steel,

in a metallic coating and painting operation.

We expect discussions with Tata Steel to be

completed in early 2006 calendar year. The

JV, if formed, would also include our existing

downstream investments.

INDONESIA

PT BlueScope Steel Indonesia is the country's

only local manufacturer of zinc/aluminium

metallic coated and pre-painted steel. We

market a number of Indonesia-only brands,

including PELANGI® steel, ABADI® steel,

and GEMILANG® steel. BlueScope Lysaght

Indonesia services growing building and

construction markets through facilities at

Cibitung, Medan and Surabaya.

Local demand was strong throughout the

year. Enquiries related to the reconstruction

of Aceh have been high, and orders have

been secured for thousands of steel houses.

In 2004/05, our metallic coating and painting

facility at Cilegon continued to operate at

full capacity, producing record tonnages of

metallic coated and painted steel.

Our new Lysaght factory and coating line

warehouse represents the first use of our

own PEB design for a BlueScope Steel facility.

The project was completed within six months

of breaking ground, and boosts Lysaght's

presence in the Indonesian building products

market. In April, BlueScope Steel entered

into an arrangement with leading Indonesian

company PT Krakatau Steel, under which

they are supplied with steel slab from Port

Kembla Steelworks. The steel slab processed

by Krakatau Steel is then supplied as coil to

some of our Asian facilities. The arrangement

potentially contributes $100 million to the

vital Australia-Indonesia trade relationship.

MALAYSIA

BlueScope Steel Malaysia, a joint venture with

PNB Equity Resource Corporation Sdn Bhd, is

the country's only local manufacturer of both

ZINCALUME® steel and Clean COLORBOND®

steel. The business supplies markets in

Malaysia, Singapore, Brunei and Sri Lanka.

We operate a metallic coating and painting

facility at Kapar, Selangor, and three BlueScope

Lysaght rollforming plants in Shah Alam,

Kota Kinabalu and Bintulu. In addition,

BlueScope Lysaght operates in Singapore and

Brunei. Production levels of metallic coated

steel were in line with last year, with a portion

going to the export market. The business

achieved record production of painted steel.

Our Malaysian operation is currently a major

supplier of feedstock to our China businesses.

THAILAND

BlueScope Steel (Thailand) Limited is a joint

venture with Thai investor Loxley Public

Company Limited. We operate a cold rolling,

metallic coating and painting facility at Map Ta Phut in Rayong province, manufacturing

ZINCALUME® steel, Clean COLORBOND®

steel and TRUZINC® zinc coated steel.

BlueScope Lysaght Thailand operates

rollforming facilities at Bangkok, Khon Kaen

and Rayong. In 2004/05, strong demand for

premium products such as ZINCALUME®

steel, Clean COLORBOND® steel and Ultima

Hi Rib® sheeting resulted in an increase in

total domestic volumes over the previous year.

A second metallic coating line in Rayong

costing $80 million has commenced operations.

This expanded plant has a total metal coating

capacity of 385,000 tonnes per annum, some

of which will be used to initially seed markets

in Vietnam and China. Our cold rolling mill

capacity is also being ramped up from 260,000

to 350,000 tonnes per year to better meet the

requirements of two metallic coating lines.

In June 2005, we announced an initial $18 million

investment in a PEB manufacturing facility to

be built at Rayong, adjacent to our metallic

coating and painting operation. This will be

Thailand's first dedicated PEB facility, and will

enhance our ability to deliver high value steel

solutions to Thailand's building and construction

markets, and to markets in neighbouring

countries. It is scheduled for commissioning

during the third quarter of calendar year 2006.

BlueScope Steel is Australia's single

largest investor in Thailand, with more than

$280 million invested (BlueScope Steel share)

over the past eight years.

VIETNAM

BlueScope Lysaght has rollforming facilities

in Hanoi and Ho Chi Minh City. The business

has been operating in Vietnam since 1993. The

resultant increase in demand for our premium

steel building products led to last year's approval

of a $160 million metallic coating and painting

facility at Ba Ria, near Ho Chi Minh City.

Building construction on this facility is complete,

equipment installation is on schedule, and

we expect to commence operating early in

2006 calendar year. Our production capacity

will ultimately be 125,000 tonnes of metallic

coated, and 50,000 tonnes of painted steel

products per year.

During the year, BlueScope Lysaght Vietnam

commissioned and launched SMARTRUSS™

into the market place. Investment is also

being made in a steel tile manufacturing

facility to commence production in the first

quarter of 2006.

|

| |

A COLORBOND® steel roof lends a dynamic profile

to the award-winning Wheatsheaf Residence in Central Victoria.

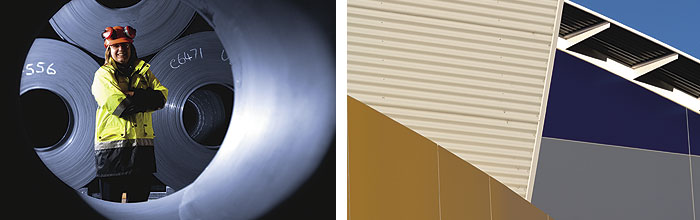

This business includes Lysaght and BlueScope Water. Both operate in high-value steel markets that demand advanced products and a strong customer focus. Our iconic LYSAGHT® range of steel building solutions inspires Australia's architects and builders, while BlueScope Water offers imaginative solutions for a changing world. Our logistics business brings our steel products and solutions to customers around the world.

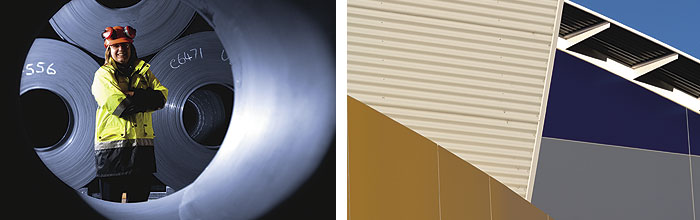

BLUESCOPE LYSAGHT

BlueScope Lysaght Australia manufactures and distributes LYSAGHT® brand steel products and services to the building and construction sectors. The brand is almost 100 years old, and holds an enviable reputation for quality. Lysaght products are made primarily made from COLORBOND®, ZINCALUME®, DECKFORM® and GALVASPAN® steels. These are purchased from our upstream business and rollformed to make roofing and walling, structural, formwork, framing, fencing and home improvement products. LYSAGHT® branded products are manufactured and marketed through 34 BlueScope Lysaght sites across Australia.

CONTINUOUS PRODUCT INNOVATION, STRONG BRANDS AND RAPID RESPONSE KEPT US AHEAD IN A TIGHT MARKET.

In 2004/05, BlueScope Lysaght continued to boost its manufacturing, sales and marketing capabilities. In December 2004, we acquired Ranbuild, a successful designer and distributor of prefabricated steel garages, barns and farm sheds, with a comprehensive re-seller network across Australia. Ranbuild has been operating since 1948, and has a longstanding commercial relationship with BlueScope Steel. The acquisition is meeting expectations.

During the year, we launched a number of new products and services, including Mobile Roll Forming which offers customers on-site manufacture of long roof sheeting; W-Dek, an economical structural decking system; and Quikform, a load-bearing concrete walling system that enables fast multi-storey construction.

We also opened several sites during the year. Our new Home Improvement Centres are capitalising on rapid growth in Sydney's west and Melbourne's southeast, while new Trade Distribution Centres have been well received in Queensland and Victoria.

A celebration of steel (from left): Colonial Brewing Company, Margaret River, Western Australia; Nambool Visitor

and Accommodation Complex and Environmental Learning Centre, Victoria.

BLUESCOPE WATER

Water shortages and water quality continue to be a significant issue for many communities. The BlueScope Water business complements an increased emphasis on water conservation across all BlueScope Steel's operations.

During 2004/05, BlueScope Water developed both manufacturing and retail capabilities in Melbourne, Sydney and Brisbane to service the growing urban market for tanks and rainwater harvesting systems. While rainwater tanks are common in rural Australia, they are becoming more prevalent in cities, in response to urban Australians' greater awareness of water scarcity. The acquisition of Perth-based Pioneer Water Tanks in May has further expanded the product and geographic footprint of BlueScope Water. Our product portfolio now includes rural, industrial and commercial water storage tanks up to 2.5 million litres. We service Australian markets as well as a growing export market that covers some 20 countries.

Along with the recently established product brands HYDRORIB® drainage pipes, WATERPOINT CLASSIC® and WATERPOINT SLIMLINE® rainwater tanks, several new brands were added through the year. These include AGRIRIB® low pressure irrigation pipe and GALAXY™ water tanks from Pioneer Water Tanks. BlueScope Water is well positioned for growth in this emerging market.

Daniel Wyatt and Christine Slade, BlueScope Water, Keysborough, Victoria.

LOGISTICS

BlueScope Steel is one of Australia's largest users of domestic road and rail services, and a major customer of international shipping services. Strong logistics capability is essential to the success of our operations. In 2004/05, our Company faced significant increases in marine freight costs. However, our longer-term contracts partly offset the effect of spot price movements, with iron ore import freight costs remaining substantially below prevailing market rates. Nevertheless, our marine freight costs increased by $70 million during the year.

To ensure our Company's new markets are fully serviced, we developed a number of key logistics partnerships across our Asian business in 2004/05. In Australia, strategic improvements continued, including a significant review of our rail contracts, as well as a number of marine and road-based contracts.

|

| |

Canberra International Sports and Aquatic Centre.

Australian Manufacturing Markets delivers innovative steel products to the building and construction, manufacturing, automotive and packaging industries, and to export customers. This business segment produces COLORBOND® steel and ZINCALUME® steel - two of Australian industry's best-known brands. These are foundation products for a wide range of steel applications, and bring unique structural and aesthetic choices to the market.

2004/05 was a difficult year for this business segment, as it dealt with the impact of dramatic increases in steel feedstock prices, as well as industrial action. This led to the segment recording an EBIT loss of $116 million. The second half-year saw earnings improve significantly as selling-price increases were implemented to restore margins. Our decision to withdraw from the export tinplate market resulted in $25 million of additional depreciation and restructure costs. Sales revenue for the year was up to $3.19 billion, compared with $2.88 billion the previous year.

WESTERN PORT

Our Western Port facility converts steel slab from Port Kembla into hot and cold rolled coil and metallic coated and painted steel products, including ZINCALUME® and COLORBOND® steels. Western Port is an important part of southern Australia's manufacturing and building sectors.

Industrial action during the year delayed completion of planned maintenance on the hot strip mill, cold strip mill, and other plants, and deprived Western Port of around 130,000 tonnes of production, at a cost of $40 million. Regrettably, many of our customers also experienced considerable disruption to their operations.

However, a site-based Enterprise Bargaining Agreement (EBA) was certified in March 2005, covering a four-year period. Our people put enormous energy into business recovery during the year, restoring delivery performance levels and ensuring our customers are restocked. Work to expand metallic coating capacity will be completed around the end of the 2005 calendar year, and will increase this capacity by 30,000 tonnes per annum.

Replacement of pickle tanks was successfully completed in January 2005. This will increase capacity by 15,000 tonnes per annum, and improve energy costs and operational security.

ILLAWARRA COATED PRODUCTS

In the Illawarra region of NSW, adjacent to Port Kembla Steelworks, we operate a group of facilities that convert steel feedstock to branded BlueScope Steel products such as COLORBOND® and ZINCALUME® steels. Tinplate and blackplate for our Australian packaging industry customers are also produced at this site.

In 2004/05, our Springhill coated steel plant again achieved several production records. For the first time the plant exceeded one million tonnes in total despatches, up 69,000 tonnes on last year, to 1.005 million tonnes. This was the plant's third successive record year for total despatches, while it also achieved the milestone of producing its 20 millionth tonne of metallic coated steel.

Separate production records were set by Springhill's rolling, metal coating, and painting operations. The cold rolling operation produced 934,000 tonnes, up from 901,000 tonnes the previous year. The metal coating operation produced 761,000 tonnes, up from 742,000 in 2003/04. The painting operation produced 158,000 tonnes, up from 152,000 in 2003/04. This excellent performance reflects the plant's strong focus on quality and manufacturing excellence.

From left: Leanne Barrett, customer service manager, whose customers include Australian Manufacturing Markets;

A design feature from the Canberra International Sports and Aquatic Centre.

In 2004/05, brownfields initiatives continued to raise capacity and reduce costs. Modifications to paintline ovens, completed in March 2005, will deliver an additional 12,000 tonnes per year, while improvements to metal coating lines will deliver a full-year capacity increase of 35,000 tonnes.

WE DEALT WITH A NUMBER

OF CHALLENGES TO IMPROVE OUR EARNINGS

IN THE SECOND HALF.

After endeavouring for many years to make our packaging products business profitable in an oversupplied global market, we decided in April 2005 to withdraw from the export tinplate market. This will allow an additional 250,000 tonnes of hot rolled coil to be redirected to other, more profitable BlueScope Steel products and markets. During 2004/05, the packaging products business contributed an EBIT loss of $109 million to this business segment.

However, BlueScope Steel remains committed to the Australian packaging market. At the end of 2004/05, we negotiated new contracts with our major domestic customers.

These commitments reflect our strong value proposition, and will assist the ongoing viability of our domestic tinplate business. For the expected impact of the restructure of packaging products during 2005/06, please refer to Note 2 - 'Australian Equivalents to International Financial Reporting Standards.'

SERVICE CENTRE NETWORK

BlueScope Steel's Service Centre network processes flat steel products for use by the building and construction, automotive, whitegoods and rural sectors, and generates around 40 per cent of our Australian statebased sales of coated and painted products. The seven sites offer custom slitting and shearing services, while three - Acacia Ridge in Queensland, CRM at Port Kembla, and Chullora in NSW - also operate paint lines.

In 2004/05, the Service Centre network, like our other downstream businesses, was negatively affected by high input costs and industrial disputes.

During the year, scheduled outages on the Acacia Ridge and CRM paint lines caused a slight drop in production, down 4% on last year to 155,000 tonnes. However, increased demand saw slitting production up 1% on 2003/04, to 425,000 tonnes.

In December 2004, we announced the development of a new, state-of-the-art COLORBOND® facility in western Sydney at a capital cost of $120 million. The project, positioned to benefit from the rapid growth of the surrounding region, is expected to be operational by the middle of the 2006/07

financial year.

|

| |

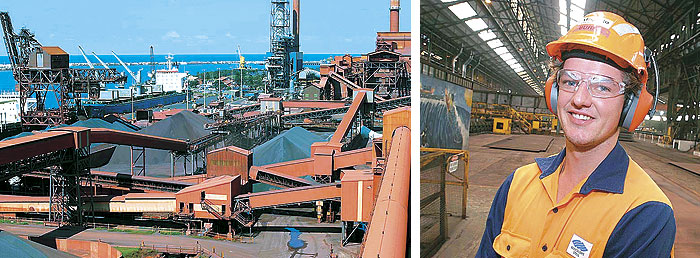

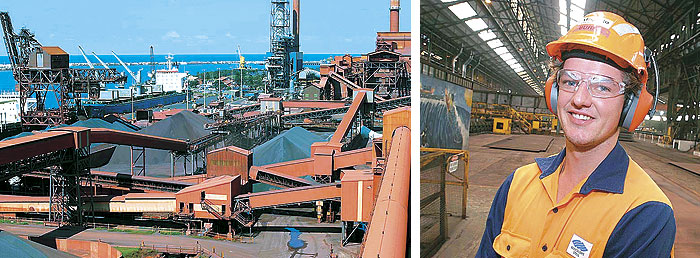

Port Kembla Steelworks slabmaking.

Port Kembla is among the world's best Steelworks, and in 2004/05, it once again demonstrated steelmaking strength. International and domestic pricing for hot rolled coil, steel slab and plate was very strong. These high steel prices, combined with near record production levels led to record earnings with the Hot Rolled Products segment reporting EBIT of $1.338 billion.

This fine performance is a credit to all those who have worked hard to improve the Steelworks over many years.

WITH RECORD EARNINGS AND NEAR RECORD PRODUCTION, PORT KEMBLA STEELWORKS CONSOLIDATED ITS REPUTATION.

Located 80 kilometres south of Sydney, Port Kembla Steelworks is a fully integrated operation with all three major production phases - ironmaking, steelmaking and shaping - taking place on site. Port Kembla uses the Basic Oxygen Steelmaking process to produce steel slab, hot rolled coil and plate. It employs around 3,500 people, and has the advantages of a deepwater port and close proximity to coal mines.

Port Kembla is a highly cost-efficient steelmaking facility by world standards, and our capital investment program is aimed at maintaining this edge.

In 2004/05, Port Kembla maintained near-record raw steel production levels, with 5.123 million tonnes produced in 2004/05, compared with 5.145 million tonnes the previous year.

The Steelworks also set a record for hot rolled coil production, achieving 2.522 million tonnes, up from the record 2.501 million tonnes produced in 2003/04. This was due to improvements in all areas of mill operations, including the slab re-heat furnace throughput rate.

A marked improvement was achieved in finished plate production, with 374,000 tonnes produced, up from 349,000 tonnes last year, due to continuous improvements in plant reliability, and working extra production shifts to meet high domestic demand. Improvements to process stability also led to the best coke production levels since 2001, with 2.374 million tonnes produced during the year.

Export despatches for the year totalled 1.4 million tonnes, with Port Kembla Steelworks continuing to make a major contribution to Australia's balance of payments.

To ensure Port Kembla Steelworks' excellence, we continue to invest in expansion and maintenance. Our $100 million hot strip mill expansion is on schedule for completion in the first quarter of 2007 financial year. This will increase capacity by 400,000 tonnes to 2.8 million tonnes per year. Civil excavations are almost finished, and work is progressing well on the furnace structure.

During the year, we successfully replaced the No. 3 Basic Oxygen Steelmaking vessel, on time and under budget, after 21 years of operation and 33.6 million tonnes produced.

From left: Port Kembla Steelworks raw materials preparation; Matt Burke at work in our Plate Mill.

The Blast Furnace No. 5 reline study is progressing, with a final decision on the scope of work expected in 2005/06. The last furnace reline was in 1991. At this stage, we do not propose to significantly increase capacity.

In 2004/05, new iron ore supply contracts were entered into with four suppliers. These contracts provide for the Company's medium term iron ore needs.

Our premium steel brands, XLERPLATE® and XLERCOIL® have shown strong sales growth since their launch in 2003/04.

|

| |

Botany Downs Secondary School showcasing ZINCALUME® steel.

New Zealand Steel is a unique steel business, and in 2004/05 it showed its true performance capabilities. Many people have worked hard to improve this operation, and their efforts have proved fruitful, with the business taking full advantage of high demand in the domestic construction market. Export prices also rose, overcoming the effects of a strong New Zealand dollar and higher maintenance costs.

Our Steelworks, located at Glenbrook, south of Auckland, is a unique, fully integrated operation covering the entire steel supply chain. It uses our iron-rich sands and locally sourced coal to produce around 600,000 tonnes of steel slab each year. Slabs are processed into hot and cold rolled products, which are then on-sold, or further processed into products such as hollow sections, galvanised steel, and ZINCALUME® steel and COLORSTEEL®.

THIS BUSINESS TOOK FULL ADVANTAGE OF STRONG MARKET DEMAND, REWARDING THE EFFORTS OF THOSE WHO HAVE WORKED HARD TO IMPROVE IT.

The business operates an extensive customer service network, selling to domestic and international markets.

In 2004/05, New Zealand Steel, including our Pacific Islands business, achieved EBIT of $183 million, an increase of 195% over last year, showing the benefit of higher domestic and export prices. Strong prices for the steelmaking by-product vanadium slag also contributed.

In 2004/05, New Zealand Steel achieved record domestic despatches of 315,000 tonnes, compared with 272,000 tonnes the previous year.

Slab production was 610,400 tonnes, slightly down on last year's figure of 611,300 tonnes, due to scheduled maintenance work. Major scheduled shutdowns in the iron plant, steel plant and hot strip mill occurred during the second half-year.

The metallic coating line achieved an annual production record of 217,000 tonnes, up from the previous record of 197,000 tonnes set in 2003/04, and despite a scheduled shutdown. An induction oven was successfully commissioned in February, and capacity is now 230,000 tonnes per annum. Paint line production was 52,000 tonnes, consistent with the previous year. An oven upgrade, completed in February, has lifted capacity to 60,000 tonnes per year.

From left: New Zealand Steel employee Peter Duffey, Fitter/Turner - Rolling Mills; Iron sands mining operations.

In May, we reached agreement on a three-year Employment Contract. Procurement initiatives provided cost savings of around NZ$2.5 million, and will continue to deliver savings in 2005/06. During the year, we made improvements to management systems, and also replaced ageing finance, maintenance and supply systems at a cost of $NZ13.5 million. We expect these changes to further enhance productivity in 2005/06.

|

| |

The Liquid Plastic company selected a customised BUTLER® PEB.

North America is an exciting part of BlueScope Steel's world. While recent strong steel prices have favoured our upstream businesses, we are working hard to enhance our downstream operations, positioning our Company to become this region's leading steel building solutions business.

Our North America portfolio consists of four businesses: North Star BlueScope Steel operates a mini-mill at Delta, Ohio in which we hold a 50% share; Butler Buildings is the country's leading designer and producer of pre-engineered steel building systems (PEBs); Vistawall manufactures aluminium and glass architectural products; Castrip LLC is a joint venture company commercialising new steelmaking technology.

In addition, our International Markets business brings Bluescope Steel products from Australia, New Zealand and elsewhere to our customers in North America.

In 2004/05, North Star BlueScope Steel delivered a record result, due to strong international steel prices and operational excellence. Our newly acquired Butler Buildings business is being successfully transformed and integrated into the BlueScope Steel family. Our Vistawall business is robust, and growing well without the capital constraints of previous ownership, while Castrip LLC is providing exciting glimpses of the future.

WE ARE TRANSFORMING OUR NORTH AMERICA BUSINESSES, EXTENDING OUR VALUE CHAIN AND CREATING THE REGION'S LEADING STEEL BUILDING SOLUTIONS OPERATION.

NORTH STAR BLUESCOPE STEEL

As with our other steelmaking businesses,

North Star BlueScope Steel enjoyed an

excellent year in 2004/05. The business

achieved a substantial increase in EBIT,

contributing $194 million to BlueScope

Steel's results. Higher domestic prices for

steel in the United States, combined with

excellent operational performance, enabled

North Star BlueScope Steel to achieve its

highest ever EBIT result, despite rises in

scrap feedstock costs.

Our partner in this venture is North Star Steel,

a subsidiary of Cargill Inc. The combined

experience and efforts of the partners,

together with state-of-the-art technology,

has made this business an industry leader. In

November 2004, North Star BlueScope Steel

LLC made its final debt repayment, and is

now debt-free. The business has since begun

paying dividends to owners. In 2004/05, the

business set a number of records. Production

was 1.824 million metric tonnes, exceeding

forecasts, and up from the previous record

of 1.710 million metric tonnes in 2003/04.

This was due to increased slab caster

throughput, improvements to the Electric

Arc Furnaces and rolling mill, and overall

operational strength.

Steel industry customers again voted this

business 'number one flat rolled steel

supplier in North America' in the prestigious

Jacobson survey. North Star BlueScope Steel

beat 30 other steel mills in areas such as

quality, service, on-time delivery and

overall satisfaction.

BUTLER BUILDINGS

Since acquiring Butler Manufacturing Company in April 2004, we have implemented a fast-paced and broad ranging transformation

program to realise the latent value of this

iconic North American business. Butler Buildings

is the industry's leading brand, with the

strongest distribution network. By combining

the best of Butler with BlueScope Steel,

we aim to create a distinctive steel-based

building solutions business in North America.

We are making good progress toward this goal.

Butler Buildings supplies PEBs for many

applications, including warehouses,

manufacturing facilities, rural buildings, offices,

retail, schools, aircraft hangars and stadiums.

It is market leader in non-residential PEBs

in the United States, Canada and Mexico,

and is supported by a sales network of

1,100 Butler Builders.

During 2004/05, we undertook a program

to strengthen Butler Buildings. This included

closure of the high-cost Galesburg facility,

numerous cost reduction initiatives, and

management structure and process

improvements.

We also introduced steel feedstock from

North Star BlueScope Steel and linked steel

supply from our Australasian operations

to Butler Buildings, via our longstanding

North American customers. Our review of

non-essential assets continued with the

divestment of the disused Alabama facility

in May, for US$1.3 million, while the sale of

the Galesburg facility is progressing.

Butler Buildings improved its performance

in 2004/05, despite inconsistent market

demand, the previous state of the business,

the scale and speed of our transformation

program, and high and volatile prices for

steel and other raw materials. Shipments

were steady at 186,000 tons - the same

as the previous year.

Butler Buildings has excellent design and

technical capabilities, strong, well-recognised

brands in a high-value market, and is

providing support for global downstream

growth initiatives such as our China

business. We are reinvigorating Butler's

licensee relationships, and believe this

business holds great potential as a strong

platform for growth in North America.

The Applied Industrial Technologies Office in Cleveland, Ohio features a stunning Vistawall façade.

VISTAWALL

2004/05 was a year of solid performance for

Vistawall, which manufactures and markets

extruded aluminium store-fronts, curtain walls,

doors, windows and skylights. Aluminium

despatches were up 12% (by weight) on the

previous year and the business gained an

estimated 2% market share. Profitability was

strong, in line with expectations and despite

rising aluminium feed costs.

Following our acquisition of Vistawall, an

independent review confirmed our expectations

of this business. It is strong in operational

performance, sales capability, and product

range, while service levels and growth

potential are high.

We have invested to increase our sales and

marketing capability, while our expanded

range of service centres will boost our market

presence in sales and engineering. During the

year, we launched a number of new products,

including Solar Eclipse sunshades, Reliance

Wall, and Terra Swing terrace doors. We

also approved a major expansion of our

Tennessee plant to double our extrusion

capacity - this will be commissioned on

schedule in late 2005 calendar year.

CASTRIP

Castrip LLC is a joint venture company

developing a revolutionary strip casting

process that allows direct production of thin,

hot rolled coil from molten steel, bypassing

slab casting, hot rolling, and potentially

cold rolling. This technology was pioneered

at Port Kembla Steelworks. Our partners in

Castrip LLC are the US Steel company, Nucor,

and Japan's IHI Heavy Industries.

The world's first commercial Castrip® facility

operates at Nucor's Crawfordsville, Indiana

plant, allowing Castrip® material to be

introduced to the market. In 2004/05, the

Castrip® process moved closer to large-scale

production with Nucor announcing its intention

to build more Castrip® facilities. A number

of steelmakers have expressed interest

in acquiring a Castrip® licence, and

negotiations are continuing.

|

|

|

|

|

| |

|

| | | | | |